Indian stocks with low peg ratio

Indian stock market growth under valued stocks shares PE ratio

Welcome to Financial House Home I Trading account Opening I Write to us I Our Target I Useful sites I Investing in Stock Market I Stock Market Books I. Information presented on this site is a guide only. It may not necessarily be correct and is not intended to be taken as financial advice nor has it been prepared with regard to the individual investment needs and objectives or financial situation of any particular person.

Stock quotes are believed to be accurate and correctly dated, but www. Financial contents like Technical charts, historical charts and quotes are taken from NSE and Yahoo sites.

Note - All quotes are delayed by 15 minutes and unless specified. Google Adsense Ads are posted on every page of the website so visitors clicking on Ads and going to those links and carrying any financial deal is not at all related to www. Please read our Disclaimer page before using any material or advice given at www.

How to study the company before investing? What is Fundamental Analysis. Invest in Good Company. Current Valuations of the Shares. Debit status of the Company. What is Fundamental analysis?

Fundamental analysis is basically done for long term and mid term investment which is also called as delivery based investment or trading.

The main important aim behind is to study and understand the company in which you are planning to invest your hard earned money and get excellent returns. Generally hard core fundamental analysis is very and is out of the scope of this website, but if you are interested to learn then please contact us and we will provide you appropriate resources to study the same.

How to analyze the fundamentals of the company? Basically one should be able to judge at least how the company has done in past years, its debit status, its current valuation, its future growth prospects, its earning capacity etc So that based on these terms he can at least decide whether to invest in this company or not. What you should look for in a company to invest? About Company - What the company is doing and what are its businesses?

How is the current demand for their products and how the demand will be in future like in next 3 to 5 years and so? It is difficult to analyze the future demand yourself so you can visit financial websites or contact us 2.

Earnings - This is very important parameter. Broadly look into its last 5 or 10 years earnings whether the company has posted profits or losses. The bottom line is investors want to know how much money the company is making and how much it is going to make in the future.

To find the earning status ratios used are EPS - Earning per share 3. Current valuation - This is another very important factor which most of the investor forgets while doing their investments. Generally most of the investors invest at higher valuations of shares and when share prices start coming down then they keep worrying, so this should not happen.

Before investing one should check the current valuation of the share price and invest only when the share price is at right price and not at over priced share. This is what happened in January Most of the people invested at very high valuations and later on the share prices started to correct falling down. To find the current valuation of the stock the ratios used are PE ratio - Price to earning ratio Book value PB ratio - Price to book value ratio 4.

Future earnings growth - It is very important to analyze how the company is going to do in future. How will be its returns or its profits etc? To find the future growth of the stock the ratios used are PEG ratio - Price to earning growth ratio Current EPS and Forward EPS Price to sales ratio.

Debit status - For any company to perform well in the future it is very important to be debt free or less debit because if company is having large debits like borrowings, loans then it becomes difficult for it to plan for any acquisitions, expansion plans take over plans, dividend payout and very important its most of the net profit goes in paying the interest and loans and other debits.

So in other words if the company is having fewer debits or no debit then they are having lots of cash in hand and they are free to take any decision in coming future. To find the debit status of the company the ratios used are - Debit ratio So to accomplish above parameters fundamental analyst follow certain ratios which are mentioned below.

Earnings - Earning Per Share - EPS EPS plays major role in investment decision. EPS is calculated by taking the net earnings of the company and dividing it by the outstanding shares. So what is that you have to look in EPS of the company?

Answer - You should look for high EPS stocks and the higher the better is the stock. Before we move on, you should note that there are three types of EPS numbers: Current EPS - Current EPS means which is still under projections and going to come on financial year end. EPS is the base for calculating PE ratio. Importance of Earnings - Earnings are profits. Every quarter, companies report its earnings. There are 4 quarters. But depending only on earnings one should not make investment or trading decision.

To make decision more risk free you should look into more tools as mentioned below so that your investment decision becomes more solid and you should get excellent returns in future.

ditycapylal.web.fc2.com | Stock Screener

Conclusion - Keep a close watch on quarterly earnings and trade or invest accordingly or manipulate your investing. To make you understand more easily we have explained in very simple steps. Current Valuations of the stocks Price to Earnings Ratio - PE ratio PE ratio is again one of the most important ratio on which most of the traders and investors keep watch.

This generally happen in bull market and share price keeps on increasing. Basically in bull market share prices keep increasing without giving more importance to its current valuation and once market realizes that it is over priced then they start selling. In bear market the low PE stocks having high growth prospects are selected as best investment options. The PE ratio is calculated by taking the share price and dividing it by the companies EPS.

Importance - The PE ratio gives you an idea of what the market is willing to pay for the companies earning. So now you would have come to know how to choose stocks based on PE ratio. What is book value? Book value is the total value of the company's assets that shareholders would theoretically receive if a company were liquidated closed. By being compared to the company's market value, the book value can indicate whether a stock is under priced or overpriced.

So in other words if the share price is trading below its book value then it is considered as under priced and good for value investing. Price to Book Ratio - PB ratio Basically PB ratio is mostly utilized by smart investors to find real wealth in shares, so investing in stocks having low PB ratio is to identify potential shares for future growth.

Like the PE, the lower the PB, the better the value of the stock for future growth. Generally, if the ratio comes below 1 then it is considered as value investing. It also depends on its future growth prospects. Future earnings growth Projected Earning Growth ratio - PEG ratio Because the market is usually more concerned about the future than the present, it is always looking for companies projected plans, financial ratios, and other future announcements.

The use of PEG ratio will help you look at future earnings growth of the company. PEG is a widely used indicator of a stock's potential value. Lower the PEG ratio the less you pay for each unit in future earning growth. A few important things to remember about PEG: It is about year-to-year earnings growth.

It relies on projections, which may not always be accurate. Following two ratios are again the projection or estimation done by either market analyst or by company resources. Forward EPS - Forward EPS which is again under projections and going to come on next financial year end.

Price to Sales Ratio The question is, is it that companies having no current earnings are bad investments? Answer is Not necessarily, because such companies may be new and trying to grow and expand but you should approach such companies with precaution. Debit status of the Company Debit Ratio This is one the very important ratio as this tells you how much company relies on debit to finance its assets. The higher the ratio the more risk for company to manage going forward.

Generally it is considered that debit ratio less then 1is good investment option. But even some investor considers higher debit ratio provided the company is having good growth prospects.

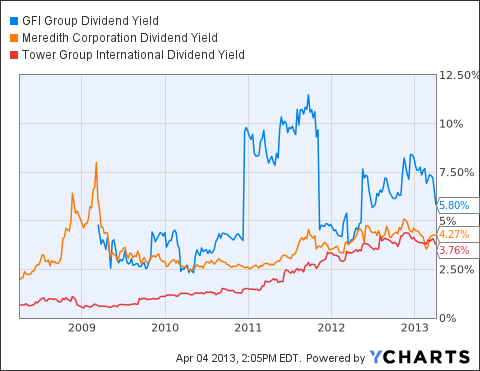

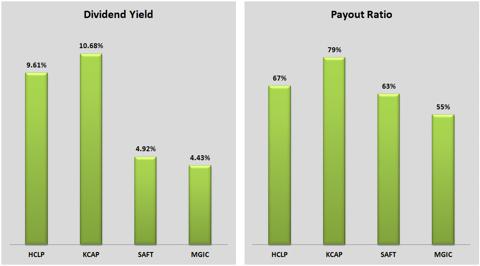

If company has fewer debits then company can make more profit instead paying for its debits like interests rates, loans etc. Dividend Yield If you are a value investor or looking for dividend income then you should look for Dividend Yield figure of the stock. This measurement tells you what percentage return a companies pays out to shareholders in the form of dividends.

Older, well-established companies tend to payout a higher percentage then do younger companies and their dividend history can be more consistent. Important Note - Any single tool or ratio should not be used to make your investment or trading decision nor will they provide you any buy or sell recommendation.

All tools should be used to find growth and value stocks. After making use of above all tools you will get excellent stocks which will give you excellent returns in mid term to long term. You will find all these ratios in any financial website or you can contact us. This would make the major impact on company. This is important point. So if you would like to have all these details and news very easily then you can keep visiting our home page www.

The company should have posted consistent growth. If you need any further clarification on any terms mentioned above then you can Contact us.