Option pricing with garch model

An option pricing model which assumes that the evolution of the underlying asset return follows the generalized autoregressive conditional heteroskedastic GARCH process. This model is used for modeling stochastic volatility in financial time series.

A GARCH Option Pricing Model with Filtered Historical Simulation by Giovanni Barone-Adesi, Robert F. Engle, Loriano Mancini :: SSRN

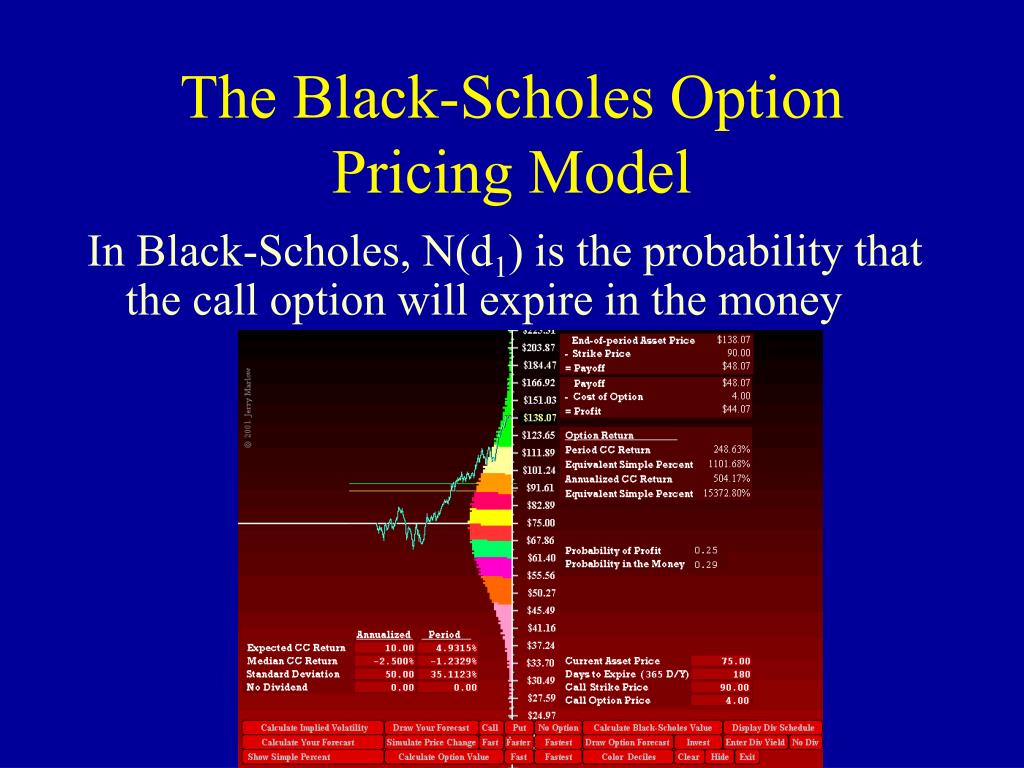

That is, it deals with the time-varying volatility of asset returns. In this respect, the GARCH model is superior to the Black-Scholes model in describing asset return dynamics, especially in terms of three distinctive features.

Derivatives | GARCH Option Pricing Model

First, the GARCH model is a function of the risk premium embedded in the return of the underlying asset. Second, the GARCH model, unlike classic models, doesn't follow a Markov process i. Third, it has potentially the ability to explain some systematic biases associated with the Black-Scholes model.

These main biases include: The GARCH option pricing model provides a tool to infer implied GARCH parameters from the market prices of traded options using Monte Carlo simulation. It, then, uses the inferred values in a manner very close to the implied volatility of the Black-Scholes model. Nevertheless, empirical evidence proved that the GARCH option pricing model produces the most accurate price effects for out-of-the-money options with short maturity.

Furthermore, the standard GARCH model can capture the smile effect of implied volatilities, but it fails to account for the volatility skew. Also, this model is not able to capture the "leverage effect" of stock returns since it assumes that there is a symmetric response between volatility and returns. As a result, and to overcome those shortfalls, the so-called Exponential GARCH EGARCH option pricing model was introduced.

Read more Comments Last update: If you are interested in supporting this project and would like to contribute, kindly see the support page , it will be a great help and will surely be appreciated. Editor About Support Sitemap Contact Copyright Privacy Policy Disclaimer.

Essential Banking Business Economics Exchanges Finance Financial Law Forex Insurance International Finance International Trade Investment Islamic Finance Personal Finance Portfolio Management Advanced Derivatives Financial Analysis Hedge Funds Investment Banking Mutual Funds Risk Management Technical Analysis Quantitative Analysis Real Estate Valuation Associate Sites Financial Encyclopedia Investment and Finance Investment and Finance Finance Quote "Since the GARCH model was introduced, plenty of extensions and variants have been worked out.