Ex dividend date stock price goes down

A common stock 's ex-dividend price behavior is a continuing source of confusion to investors.

Read on to learn about what happens to the market value of a share of stock when it goes "ex" as in ex-dividend and why. We'll also provide some ideas that may help you hang on to more of your hard-earned dollars. For more specifics on the actual evolution of the dividend payment process, see Declaration, Ex-dividend And Record Date Defined.

How does it work? Suppose we have a company called Jack Russell Terriers Inc. The ex-dividend date will be two business days earlier, on Friday, June 8.

Keep in mind that the purchase date and ownership dates differ. At this time, the settlement date for marketable securities is three days. So, to own shares on the record date i. For additional information on the stock settlement procedure see The Nitty-Gritty Of Executing A Trade.

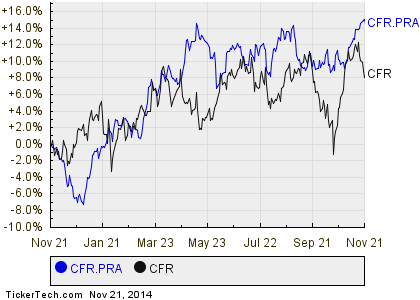

The Stock's Value What will happen to the value of the stock between the close on Thursday and the open on Friday?

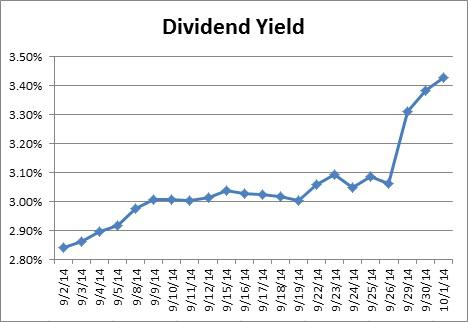

So, its price should drop by approximately this amount between the close of business on Thursday, and the open of business on Friday. The term "about" is used loosely here because dividends are taxed, and the actual price drop may be closer to the after-tax value of the dividend. As you know, the ex-date is two business days before the date of record.

The stock will go ex-dividend trade without entitlement to the dividend payment on Friday June 8, Bob owns the stock on Tuesday June 12, because he purchased the stock with entitlement to the dividend. His check will be mailed on Wednesday June 13, dividend checks are mailed or electronically transferred out the day after the record date.

Think Before You Act Now that you understand how the price behaves, let's consider whether Bob needs to be concerned about this or not.

If he is buying HYPER in a qualified account in other words, an IRA , k or any other tax-deferred account , then he should not worry too much because taxes are deferred until he withdraws his money or, if he makes his purchase in a Roth IRA , are not due at all. However, if Bob buys HYPER in a non-qualified, currently taxable account, he really needs to be careful.

Let's say Bob just can't wait to get his paws on some HYPER shares, and he buys them with a settlement date of Thursday June 7 in other words, when they are trading with entitlement to the dividend. Bob will have an unrealized capital loss and, to add insult to injury, he will have to pay taxes on the dividend he receives.

Additional Considerations This scenario also needs to be considered when buying mutual funds, which pay out profits to fund shareholders. This distribution to the fundholders is a taxable event , even if the fundholder is reinvesting dividends and capital gains. Why don't mutual funds just keep the profits and reinvest them?

Under the Investment Company Act of , a fund is allowed to distribute virtually all of its earnings to the fund shareholders and avoid paying corporate tax on its trading profits. By doing this, it can lower fund expenses taxes are, of course, a cost of doing business , which increases returns and makes the fund's results appear much more robust. What's an investor to do? Well, just like the HYPER example, investors should find out when the fund is going to go "ex" this usually occurs at the end of the year, but start calling your fund in October.

If you have current investments in the fund, evaluate how this distribution will affect your tax bill.

Glossary - Aviva plc

If you purchased shares that are currently trading for less than the price you paid for them, you may consider selling to take the tax loss and avoid tax payments on the fund distributions. If you are thinking about making a new or additional purchase to a mutual fund, do it after the ex-dividend date.

To read more on this subject, see Selling Losing Securities For A Tax Advantage. Concluding Though It's not what you earn - it's what you keep - that really matters. Being mindful of these ex-dividend circumstances should help you keep more of your hard-earned dollars in your pocket and out of Uncle Sam's coffer. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Make Ex-Dividends Work For You By Helen Simon Share. Understanding the dates of the dividend payout process can be tricky. We clear up the confusion. Not too sure what an ex-dividend date is? Find out here and learn how and when you can take advantage of a stock's dividend. Learn about the basics of mutual fund dividend taxation, including how and why mutual funds pay dividends and when different tax rates apply to dividend income. Find out how dividends affect the price of the underlying stock, the role of market psychology and how to predict price changes after dividend declaration.

Learn how the distribution of dividends on stocks impacts the price of call and put options, and understand how the ex-dividend date affects options. The process by which mutual fund dividends are calculated, distributed and reported is fairly straightforward in most cases.

Today's Stock Market News and Analysis - ditycapylal.web.fc2.com

Find out how this "first love" still holds its bloom as it ages. Understanding dividends and how they work will help you become a more informed and successful investor. If you sell before the ex-dividend date you will not receive a dividend from the company. The ex-dividend date is the date Find out why ex-dividend payments are sent to the seller of a stock rather than the purchaser and how ex-dividends can create Review the important dates concerning dividend payments and learn how the ex-dividend date is determined when a company declares An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

Understanding Ex-Dividend Dates -- The Motley Fool

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.