Hand signals trading floor

For many people, even just the words "stock exchange" invoke images of men clad in weird jackets frantically gesturing and yelling to each other while quickly scribbling on their pads. Albeit exaggerated and over-simplified, this is how a lot of exchanges be they stock, options, or futures used to function.

Increasingly, though, the human floor trader is becoming a relic of the past as exchanges go virtual and traders handle business through impersonal computer terminals and phones. With virtually all of the momentum on the side of electronic trading - there has been no major conversion from an electronic system back to the old method - is there much of a future left for human floor traders or human interaction?

Investor's Guide To Electronic Trading. Open Outcry - Previously the Only Game in Town Given that stock and commodity trading predates the invention of the telegraph, telephone or computer by hundreds of years, it is fairly obvious that face-to-face human trading was the standard way of doing business for a long time.

Some exchanges began as little more than informal gatherings of local businessmen with common interests a grain buyer and a grain seller, for instance. Over time, though, the functions become more regular and specialized, and the people involved came up with common rules and policies. Ultimately, this culminated in the creation of open outcry markets for financial instruments like stocks, bondsoptions and futures.

Rules and procedures varied from exchange to exchange, but they all had a trading floor sometimes called a "pit" where members conducted their business. For more, see The Birth Of Stock Exchanges.

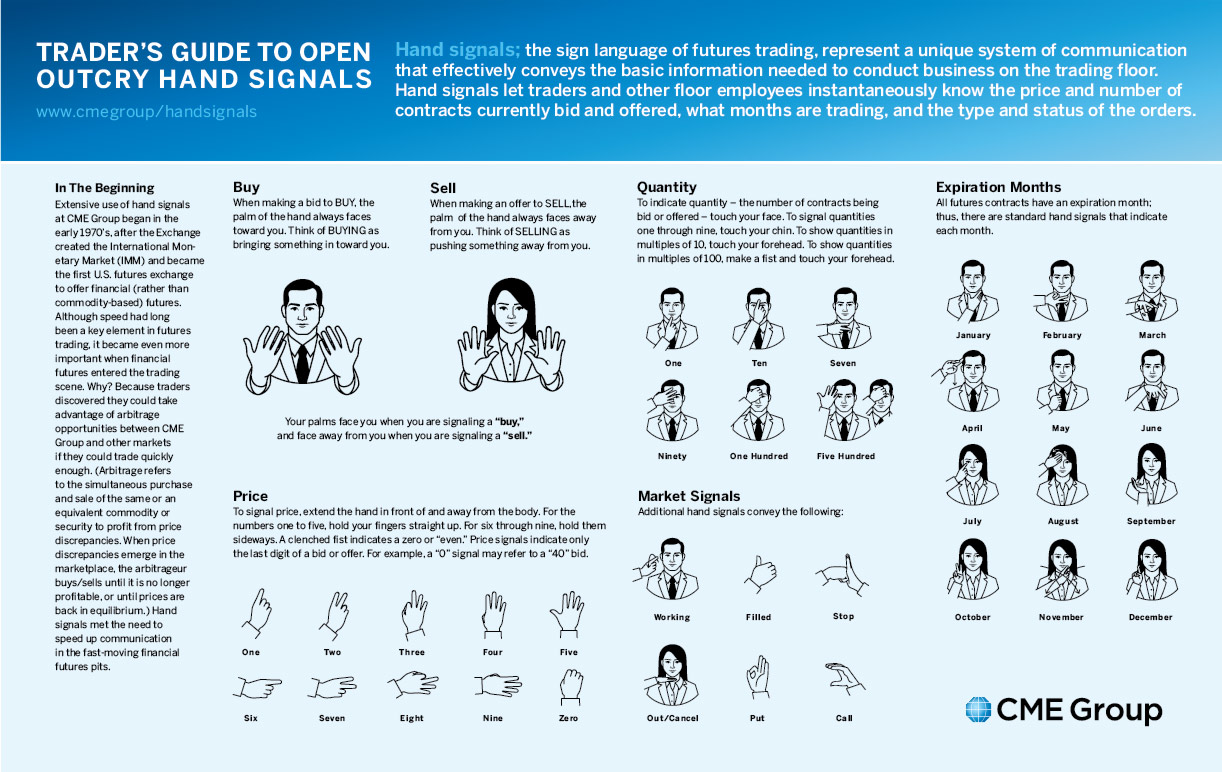

Trading was once a fairly sedate and orderly affair - traders would sit at desks and walk over to other traders to do business - but as business picked up, the interaction changed. Eventually the desks went away and sedate and leisurely trading was replaced by sometimes-frantic yelling and gesturing, with particular hand signals for buying, selling and the numbers involved.

The Rise of the Machines While a busy trading floor may look like bedlam to the uninitiated, it worked surprisingly well for the most part.

Trade EUR/USD with the experts. Free EURUSD trading news

Ultimately, though, member firms and clients began to see what technology could offer them, particularly in terms of faster execution and lower error rates. Instinet was the first major electronic alternative, coming into being in With Instinet, clients institutions only could bypass the trading floors and deal with each other on a confidential basis.

Instinet was a slow grower, not really taking off until the s, but has become a significant player alongside the likes of Bloomberg and Archipelago acquired by the NYSE in Nasdaq started inbut didn't really begin as an electronic trading system - it was basically just an automated quotation system that allowed broker-dealers to see the prices other firms were offering and trades were then handled over the phone.

Eventually, Nasdaq added other features like automated trading systems. In the wake of the crash, when some market makers refused to pick up their phone, the Small Order Execution System was launched, allowing electronic order entry. For more, see Getting To Know The Stock Exchanges.

CME's Globex came out inEurex debuted in and many other exchanges adopted their own electronic systems. Given the benefits of the electronic systems and the clients' preference for them, a very large percentage of the world's exchanges have converted to this method.

The London Buying stocks tsx Exchange was among the first major exchanges to switch, making the conversion in The Borsa Italiana followed inthe Toronto Stock Exchange switched in and the Tokyo Stock Exchange switched to all-electronic trading in Along the way, many major futures and options exchanges have likewise made the switch.

For more, see The Global Electronic Stock Market. At this point, the United States is more or less alone in maintaining open outcry exchanges. Major commodity and option exchanges like NYMEXChicago Merc, Chicago Board of Trade and the Chicago Board Options Exchange all use open outcry, as does the New York Stock Exchange.

In all of these cases, though, there are electronic alternatives that customers can use and the majority of the volume, though not necessarily the majority of dollar volume, is handled this way.

Outside the United States, the London Metal Exchange is the largest exchange still using open outcry. It may seem intuitive or obvious that electronic trading is superior to open outcry.

Certainly computers are faster, cheaper, more efficient and less error-prone with routine trades - though the error rate in open outcry trading is surprisingly low. What's more, computers are at least theoretically better for regulators in creating data trails that can be followed when there are suspicions of illegal activity. That said, electronic trading is not perfect and open outcry has some unique features. Because of the human element, traders who can "read" people may be at an advantage when it comes to picking up non-verbal cues on the motives and intentions of counter-parties.

Perhaps analogous to the world of poker, r-breaker trading system are some players who thrive forex trading zones times much on reading the players as playing the odds - and electronic trading removes those signals from the equation.

Oddly enough, human interaction is also often better for complex trades. Many of the trades that are sent to the floor at the CBOE and other open outcry exchanges are complex or unusually large. Skilled floor brokers can often get better execution better pricing by "working the order" with other traders - something that electronic systems generally cannot do so well.

Gap Trading Strategies [ChartSchool]

Find out some of the lower-risk stock market gainer to invest in foreign markets.

For more, see Playing It Safe In Foreign Stock Markets. The Future of the Floor Despite the potential advantages that human floor trading can offer to some clients, the march of electronic trading seems inexorable.

A very large percentage of stock trades are already handled this way today, and nobody seems to want to go back to the old ways. That said, so long hand signals trading floor members feel that floor traders provide a useful service and the traders themselves make enough to continue showing up, there may not be much of a push to get rid tf2 stock market map them.

Said differently, they are not hurting anybody with their presence today, so why chase them out if they wish download free forex tester 2.8.7 stay?

Nevertheless, the face-to-face human trading floor is all but dead.

Forex Trading Strategies Revealed | Beginners and Advanced Traders

Electronic trading dominates the financial world as a whole, and as the influence of large institutions on trading patterns seems only likely to rise further, the efficiency and speed of computer networks makes them an entrenched part of the trading infrastructure. For more, see the History Of The Toronto Stock Exchange.

Trailer for the 2010 documentary "The PIt"Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. The Death Of The Trading Floor By Stephen D. Simpson, CFA May 20, — 2: Investor's Guide To Electronic Trading Open Outcry - Previously the Only Game in Town Given that stock and commodity trading predates the invention of the telegraph, telephone or computer by hundreds of years, it is fairly obvious that face-to-face human trading was the standard way of doing business for a long time.

Currency Trading Guide The Future of the Floor Despite the potential advantages that human floor trading can offer to some clients, the march of electronic trading seems inexorable.

For centuries, a stock market was a physical arena where buyers and sellers traded shares. Then the NASDAQ opened and changed everything. The way trading is conducted is changing rapidly as exchanges turn toward automation. An exchange is an organized marketplace where securities and other financial instruments are traded.

Check out the history and inner workings of the world's six most well-known stock exchanges. Discover why controlled chaos can mean an exciting investment experience for you. Learn how to use this automated global electronic market maker and broker. Most stocks are traded on physical or virtual exchanges. The New York Stock Exchange NYSEfor example, is a physical exchange Learn more about the electronics sector and the challenges and opportunities presented to electronics companies by new and Read about the CBOT and Mercantile exchanges; both are futures exchanges that offer different futures contracts and specialize Owning a seat on the New York Stock Exchange NYSE enables a person to trade on the floor of the exchange, either as an An auction market is one in which stock buyers enter competitive bids and stock sellers enter competitive offers at the same Learn more about the electronics sector and the unique risks and opportunities it presents to investors.

Find out how to An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.