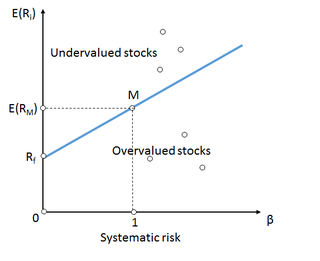

For expected stock returns that plot on the security market line

You can figure the slope of the Security Market Line with a simple formula in Excel. The SML is the slope defined by the Capital Asset Pricing Model that shows the relative riskiness of stocks compared with the performance of the market as a whole.

So the lowest point on the SML would be the CAPM of a risk-free security such as a guaranteed bond. The midpoint on the SML would be the average performance of the market and the highest point on the SML would be the CAPM of a stock that you want to evaluate. Launch Excel and create a new, blank spreadsheet. Type "Securities" in cell A1, "Rate of Return" in B1, "Beta" in C1 and "CAPM" in cell D1.

How to Graph a Security Market Line | Sciencing

Type "Risk-free" in cell A2, "Market" in A3 and "Stock" in A4. Enter the rate of return for each of the items in column B.

Capital Market Line (CML)

The risk-free rate is the highest guaranteed rate of return you can get, so a T-Bond, for example, would provide your risk-free rate. The expected market rate is the annual percentage that the average stock market will return.

The stock rate is the expected rate of return for your specific stock. Type the beta value of 0 into cell C2, type the value of 1 into cell C3.

The beta is the measure of a stock's volatility in relation to the market. A beta of one is exactly even with the market. A beta of zero is not volatile at all.

You can find the beta for your specific stock at a financial website, such as Google Finance, Yahoo Finance for expected stock returns that plot on the security market line Reuters Finance. Highlight cells D2 through D4 and then click on the "Insert" tab. Click "Line" in the Graph section you will see your Security Market Line. Stocks that how much money do paramedics make an hour above the line constitute a good risk.

Stocks that fall below the line are a poor risk, according to the SML theory. James T Wood is a teacher, blogger and author. Since he has published two books and numerous articles, both online and in print.

His work experience has spanned the computer world, from sales and support to training and repair. He is also an accomplished public speaker and PowerPoint presenter. Skip to main content. Enter the following formula into cell D2: Enter the following formula into cell D3: Enter the following formula into cell D4: Warning This does not constitute investing advice.

Security Market Line - SML Teach Me Finance: The Security Market Line Microsoft Office: Create a Chart from Start to Finish. About the Author James T Wood is a teacher, blogger and author. Suggest an Article Correction. Also Viewed [Security] How to Disable iPhone Security [Market Penetration Analysis] Market Penetration Analysis [Binding Price Floor Cause] Does a Binding Price Floor Cause a Surplus or Shortage?

Multiple Choice Quiz

Logo Return to Top. Contact Customer Service Newsroom Contacts. Connect Email Newsletter Facebook Twitter Pinterest Google Instagram. Subscribe iPad app HoustonChronicle.